Solutions

Discover how ACES provides the solutions you need, tailored specifically to your line of business.

Solutions Overview-

Mortgage Lending

ACES offers solutions for each point in the mortgage loan lifecycle from Pre Funding to Post Closing.

-

Consumer Lending

Gain valuable insights and reduce risk across all consumer lending channels.

-

Commercial Lending

Providing commercial lenders with powerful auditing tools to ensure quality and compliance throughout their loan portfolio.

-

Credit Unions

Credit Unions can leverage a single platform to obtain a holistic view of loan quality.

-

Loan Servicing

Loan servicers are able to tackle all servicing QC challenges while keeping pace with ever-changing regulatory requirements.

-

Service Providers

Third-party QC providers can ensure quality and compliance throughout their operations while providing the flexibility to scale as needed as volumes change.

Products

Explore ACES leading quality management and control product offering and start making better business decisions.

Products OverviewWhy ACES

Lending institutions of all sizes use ACES to improve productivity, efficiency and quality while controlling costs.

Why ACES Overview-

Compliance & Risk

Compliance and risk executives use ACES as an integral component of their overall risk management program.

-

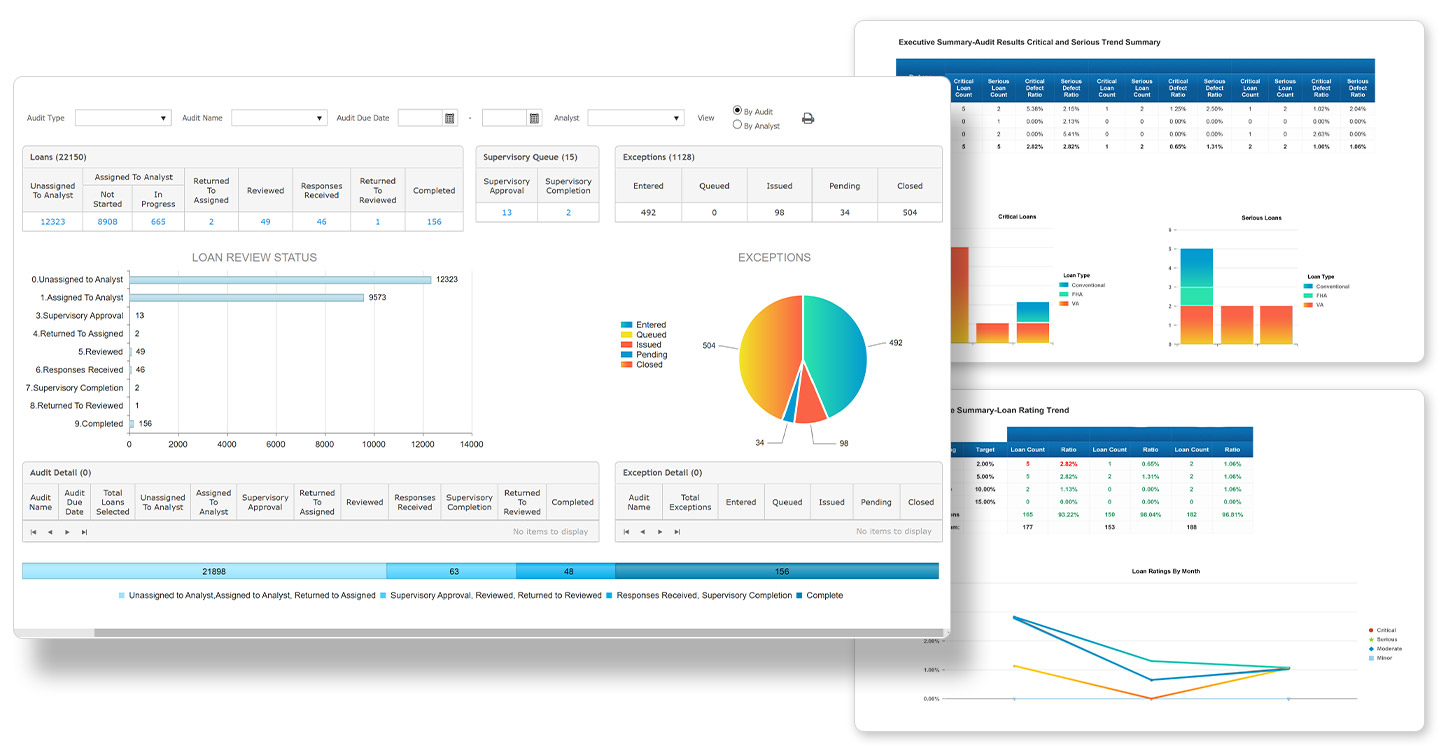

Quality Control

Quality Control executives can improve audit throughput and accuracy while controlling costs.

-

Security

ACES assures the highest level of security protocols.

-

Support & Training

Responsive support and access to our experts.

Resources

ACES offers a comprehensive library of information and client success stories.

Resources Overview-

Success Stories

Learn how ACES customers are achieving proven, measurable ROI.

-

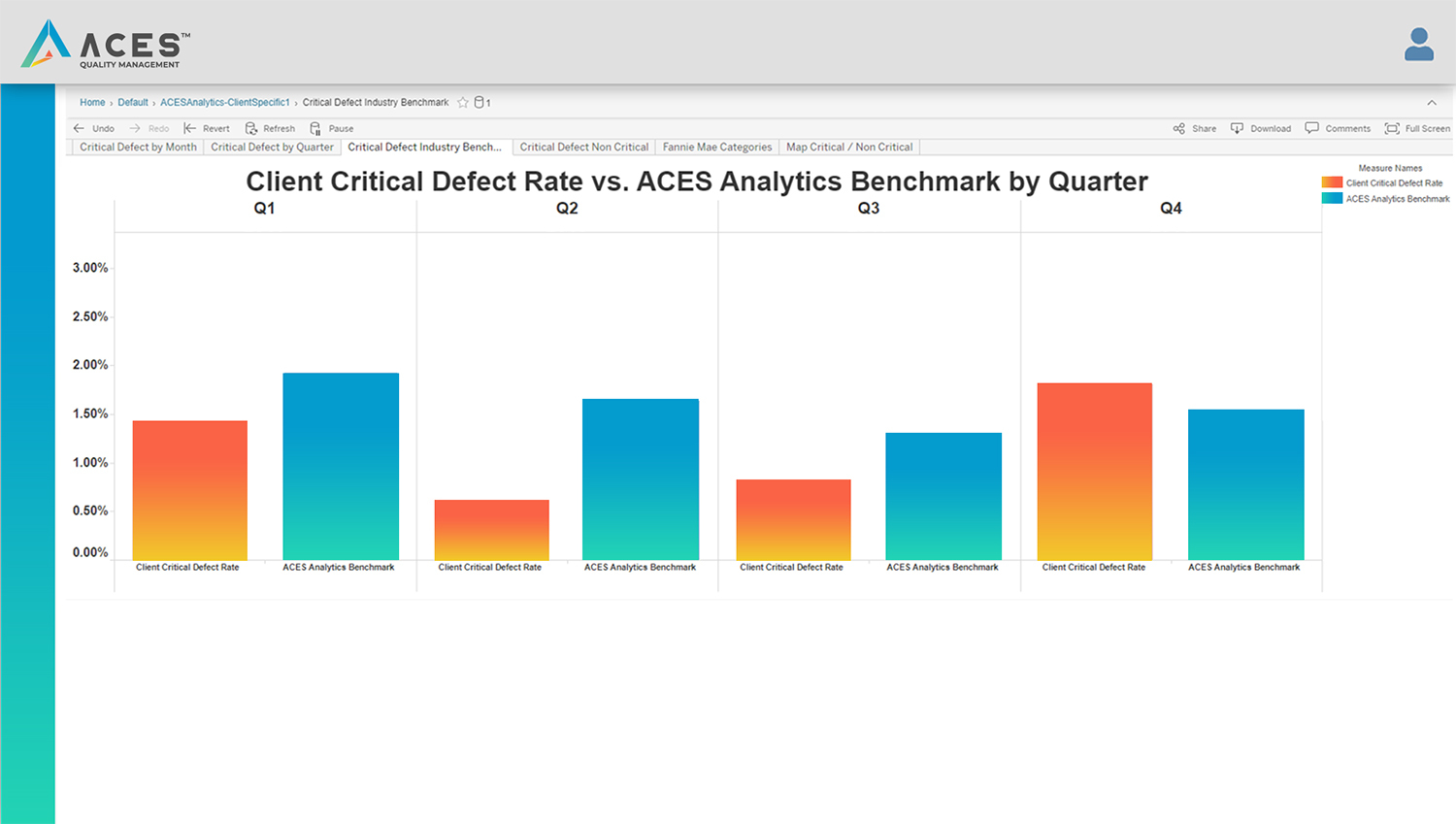

Reports

Discover the latest intel on nationwide quality control and risk activity.

-

Webinars

View our library of webinars on best practices for navigating the industry’s qc and risk trends.

-

Guides

Read white papers, guides, checklists and more authored by our team of risk and compliance experts.

-

Brochures

Learn more about ACES products features and services.

About

ACES is the leading provider of enterprise quality management and control software for the lending industry.

-

Company Overview

Learn about who we are and what we do, as a company and as a team.

-

Partner with ACES

Join our list of referral partners to augment your business offering.

-

News

Follow ACES media coverage and conference schedule.

-

Careers

Quality People behind Quality Products achieving Quality Results.